How to Create an Effective Incident Response Plan Template for TISAX® Compliance?

Automotive manufacturing, design, and assembly firms invest nearly three years to achieve various maturity and assessment levels defined by the Trusted Information Security Assessment Exchange (TISAX®) compliance framework.

Automotive manufacturers seeking a strategy to reduce the cyberattacks affecting their production operations must invest in a next-generation incident response strategy to sustain their TISAX® readiness.

Why Is this Credential Critical to the European Union (EU) Automotive Industry?

This credential is essential for these firms seeking to join the global automotive supply chain. Germany-based automotive giants, including BMW, prefer to work with supplies that successfully achieve this status. More importantly, BMW and other automotive industry leaders expect these suppliers to maintain their compliance, including enabling proper incident response capabilities.

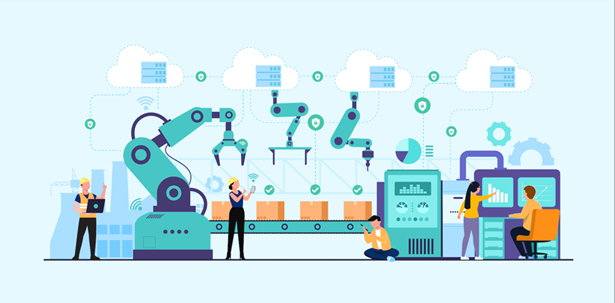

The automotive manufacturing process continues to incorporate the same effective methods found in Industrial 4.0. Industrial 4.0 frameworks rely more on automation, robotics, and integrated supply chains and less on human interaction. This framework continues to be adopted by car manufacturers wanting to streamline their production capabilities, reduce operational costs, and limit disruptions. The TISAX® compliance framework is ideal for automotive firms that standardize industrial 4.0 manufacturing capabilities.

Cybersecurity needs to become embedded on a much grander scale, including production line automation controls, robotics, and software systems controlling scheduling and workflows. TISAX® maturity and assessment levels validate whether automotive firms deployed the needed adaptive controls within their various industrial 4.0 components to ensure these systems do not become compromised.

Industrial 4.0 components deliver exceptional automation to the automotive manufacturing process. These components include:

Manufacturing Execution Systems: Companies embed computerized applications called Manufacturing Execution Systems (MES) within the manufacturing process. They monitor materials, track critical parts, and provide accountability for the product lifecycle process.

Data Analytics: The Industrial 4.0 framework within the automotive manufacturing process generates vast data from the various robotic devices, applications, and control units. A critical part of leveraging industrial 4.0 frameworks is the success of leveraging artificial intelligence (AI) and machine learning (ML).

Production Optimization: Using AI and ML, automotive manufacturers can make more efficient adjustments to their production line systems and workflows based on processed data. AI and ML also play critical roles in optimizing the automotive supply chain, designing better cars, and managing their costing models more efficiently and with less error.

These components, along with many others within the automotive industrial 4.0 framework, are critical to optimal performance. Each of these elements is a prime target for hackers.

Hackers are leveraging several attack vectors, including ransomware, denial-of-service attacks, extortion, and email phishing target industrial 4.0 factories. These vectors have already proven effective against operational technology systems controlling water, power, and healthcare.

It will become inoperable without an incident response plan integrated into the next-generation automotive manufacturing process, the production within these factories will become disrupted by cyberattacks.

Understanding the Importance of the Sustaining The TISAX®Compliance Through Effective Incident Response.

Enabling an effective security operation (SecOps) team requires an organization to invest in human capital resources, including incident response tools, automation and detection and response, cybersecurity engineers, application security engineers, and threat-hunting experts. Without the tools and engineering talent for incident response, automotive organizations will struggle to maintain their TISAX® compliance readiness.

Maintaining TISAX® maturity levels, especially for automotive firms that have achieved assessment level 3 (ALS), requires the firm to enable advanced cybersecurity controls to align with automotive giants, which require a higher level of protection of their most sensitive information. Any breach within cybersecurity protection controls or processes affects the supply chain firm and the larger automotive manufacturers.

The IRP considers minimizing any cybersecurity attack quickly and without disruption as a critical aspect.

What are the Critical Components that Comprise an Incident Response Strategy?

Incident response plans combine a series of processes that help align and govern the various adaptive controls used to stop cyberattacks. Without process and management, most adaptive controls cannot function as expected.

Incident response capabilities include:

- Continuous Monitoring: SecOps focuses on real-time monitoring networks, systems, and applications to quickly identify security threats and anomalies.

- Security Automation: Using automation tools can help simplify regular tasks, speed up incident responses, and minimize human mistakes.

- Threat Intelligence: Using current threat intelligence to address new cybersecurity risks proactively.

- Compliance Management: Ensuring security measures meet regulatory requirements and industry standards.

- Performance Optimization: Finding the right balance between security measures and system performance to ensure security and efficiency.

How Does Incident Response Stop Ransomware Attacks?

Ransomware attacks originate through email phishing. Heads of production manufacturing, the CEO, or the materials department receive suspicious emails that contain links requesting they change their password or download the “manual.” This becomes the propagation of ransomware.

How does the incident response identify this attack and act?

Continuous monitoring

As the malware moves laterality within the automotive manufacturing operations network, the SecOps continuous monitoring system will quickly detect host systems and devices attempting to open communications with adjacent systems.

Security Automation Response With Threat Intelligence

The incident response controls, powered by AI and ML, along with updated threat intelligence, detect and respond to this ransomware by containing the malware. They achieve this by shutting down ports and protocols at the VLAN level to stop the material attack.

Compliance and Performance Monitoring

After the security automation stops the attack propagation, the event telemetry becomes recorded within the extended detection and response (XDR) solution. The management and case management solution will assess the attack to maintain the integrity of the TISAX® compliance mandate. Another critical evaluation will review the key performance indicators (KPI), including mean-time-to-detect (MTTD) and mean-time-to-response (MTTR). These KPIs give SecOps insight into their automated tools’ ability to respond fast enough to prevent the attack from spreading.

This performance review helps the SecOps team learn from the various attacks using their IRP and provides insight into areas for improvement.

What is the Ideal IRP Template for Organizations to Leverage?

Creating an ideal IRP plan starts with leveraging the SMART principles. The IRP plan needs to include:

S- Simple

IRP plans to support TISAX® must be simple to maintain, adjustable, and remain sustainable, even with additions, moves, and changes to policies and adaptive controls.

M- Measurable

The IRP needs to ensure the operation generates accurate reporting for TISAX® compliance. Automotive manufacturers will query their supply chain partners to show their compliance with TISAX® and provide reports and results of previous assessments.

A-Attainable

Automotive suppliers need to ensure the level of assessment and maturity align with their business requirements and their ability to maintain their cybersecurity IRP and compliance posture. Pressing forward with a high assessment level without a properly maintained SecOps function will lead to compliance status failures and cybersecurity attacks.

R-Realistic

Are your current SecOps resources capable of supporting an IRP plan for TISAX® compliance? Or do you plan to augment internal resources with a managed services offering? These decisions need to be realistic if the automotive firms want to remain compliant with TISAX®.

T-Timely

Will implementing a new or existing IRP strategy with the expectation of meeting the various assessment and maturity levels of TISAX® be in the correct timeframe? Is the IRP plan overly complex and challenging to enable it to meet the various TISAX® mandates? CIOs and CISOs need to allocate the proper amount of human capital and financial resources to execute the IRP strategy and align it with the timeline of achieving and sustaining compliance for TISAX®.

Effective ways to implement an Incident Response Plan include regularly testing, training, and updating the plan.

Implementing effective practices for an Information Security Incident Response Plan (IRP) for TISAX® begins with the organization recognizing its significance and relevance to the business’ success. Maintaining an IRP requires human and financial capital. This strategy for TISAX® is not something you review once a quarter or yearly.

Here are standard functions that should help any automotive organization maintain its IRP:

Testing: Hiring a third-party pen tester or assessment firm to validate that your IRP is operational and functioning as required. This step is necessary for assessment level 3 within TISAX®.

Training: Security awareness training for the end user community and the SecOps engineers is critical in preventing cyberattacks and maintaining the various controls with the IRP plan.

Continuous Monitoring and Remediation

Continuous monitoring and remediation, including patching critical hosts, devices, and cybersecurity adaptive controls, are essential for the IRP plan to work effectively. Unpatched systems become prime targets for hackers, increasing the number of events the SecOps must manage.

Common Challenges and Solutions Identify common challenges organizations face when developing and implementing incident response plans.

Enabling an IRP plan for TISAX® and other business and compliance requirements faces several challenges, including cost, lack of resources, and an overwhelming number of attacks. IRPs need to be fluid, agile, and well-funded to meet the constant changes in the global threat landscape.

Often, the challenges become the nucleus for organizations to invest in a relationship with managed detection and response providers.

TISAX® is a registered trademark of the ENX Association and bears no responsibility for the content of the services offered by ForeNova Technologies B.V